In September at the Allocator One Summit in London, something rare happened: GPs and LPs sat together not just to discuss returns, but to reflect on the stage of the industry where alpha truly comes from. Vanagon, approaching its Final Closing in December, was on stage as the European “Breakout Fund 2025” and we presented our story, strategy and portfolio companies in front of >300 investors.

Last week, also The Alpha Report 2025, presented by Allocator One was released and left us with a clear message: venture is at a crossroads. Despite record startup activity ($368B raised in 2024), fundraising for new funds collapsed to a decade low. Capital is scarce, concentrated in a handful of mega-firms, while conviction-led managers - those reading signals before consensus - remain underfunded.

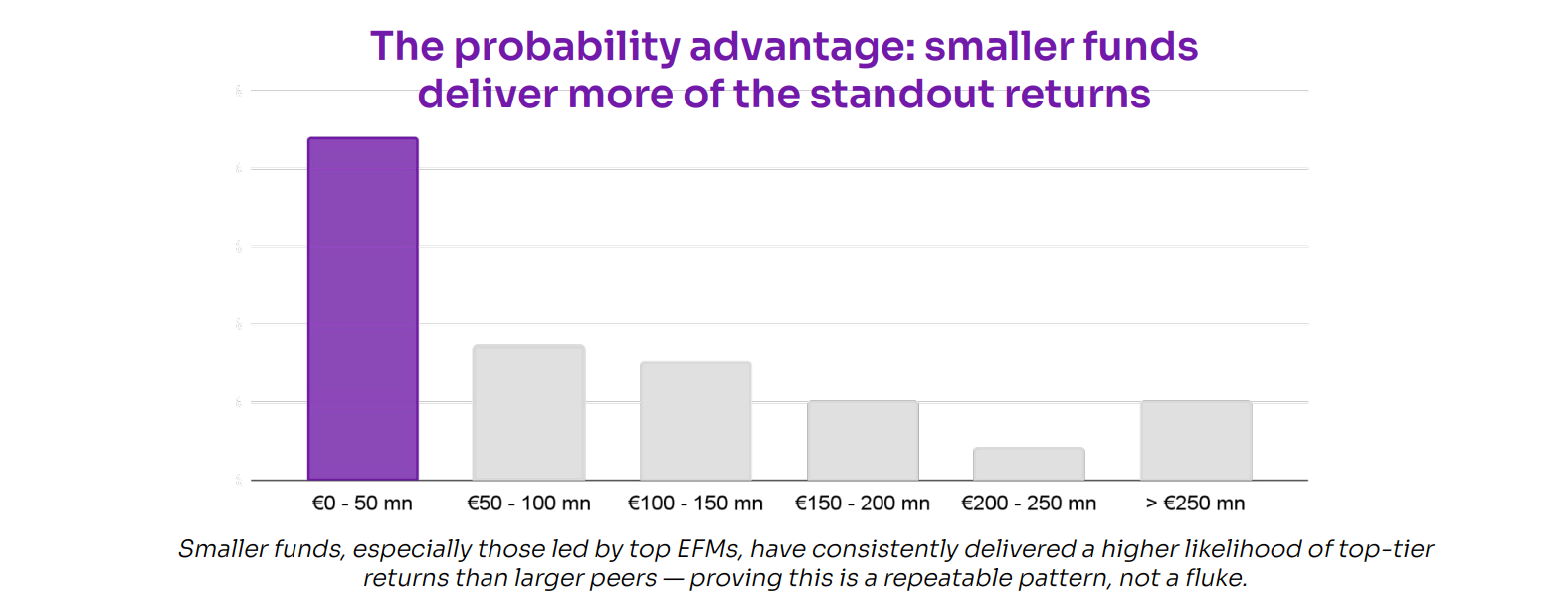

And here comes the twist: Emerging managers have turned this scarcity into an edge:

They outperform consistently — smaller, focused funds generate more of the standout returns than incumbents

They thrive where traditional VCs hesitate: early signals in AI-native infrastructure, climate adaptation, applied robotics, and dual-use technologies.

They benefit from distinctive founder profiles

Former operators who translate lived founder pain points into sharper investment theses, community builders who turn trust networks into sticky deal flow, or ultra-niche experts who spot contrarian signals before they are obvious to the market

The report distilled this into the Alpha Equation:

Alpha = (Signal edge × Frontier readiness × Attribute fit × Capital innovation) ÷ Consensus noise

For teams like us, the question is less if venture will drive the next wave of innovation, and more where we choose to further engage before consensus catches up.

For allocators, the lesson is clear: alpha doesn’t come from chasing consensus, but from partnering with those rare individuals who see the world a few years earlier, and have the resilience to hold their conviction until the world catches on. That is not only a financial bet — it’s a philosophical one. It’s about deciding to place trust in conviction rather than comfort.

“We thrive on contrarian bets - every breakthrough looks improbable at first, until talent, capital and conviction converge long enough to make it inevitable.”

And perhaps that is why gatherings like the Allocator One Summit matter: they remind us that in a chaotic and polarized market, conviction-led venture is not a luxury. It is the only path to building the kind of durable innovation and resilience Europe and the World urgently needs. Thanks to Michael, Felix and the whole Allocator One Team.

Bests

Axel, Sandro & Susanne

Vanagon is a (pre-)seed fund based in Munich: Europe’s DeepTech hub. We are purpose-built for sovereign-edge technology in Industrial, Nature, and Digital Infrastructure - to seize the €3T DeepTech opportunity in Europe. Our fund size & setup reflects exit realities and maximizes return opportunities: For high returns, unicorns are optional, not required. We are partners from day one, writing cheques of up to €500k to fuel the journey to Series-A and beyond. Our founders know the edge we bring: 36zerovision, Bench, Sibyllion, Holy Technologies, Exomatter, The Landbanking Group, Senken, Particula