If the past five years have taught us anything, it’s this: we are living through another full-blown era of VUCA — volatility, uncertainty, complexity, and ambiguity.

COVID-19 reminded us how fragile and interconnected the global economy truly is. Supply chains cracked, trust in institutions wavered, and digital transformation accelerated by a decade — in months. We got through it.

Now we face a different kind of storm. Geopolitical fragmentation, deglobalization, new tariffs, populism, and policy shocks are re-shaping the investment landscape. Europe is navigating a new reality still inbetween shock and forward-dynamism.

It’s tempting to pause, wait it out, let the dust settle.

But in venture, these are precisely the moments where the best vintages are born, and where the next generation of category-defining managers quietly emerge. We’ve seen this movie before — and we know how it ends: those who lean in early, thoughtfully, and with discipline, are the ones who shape the next decade.

This issue is dedicated to that belief — and to those who back bold ideas when the world is uncertain.

Let’s dive in.

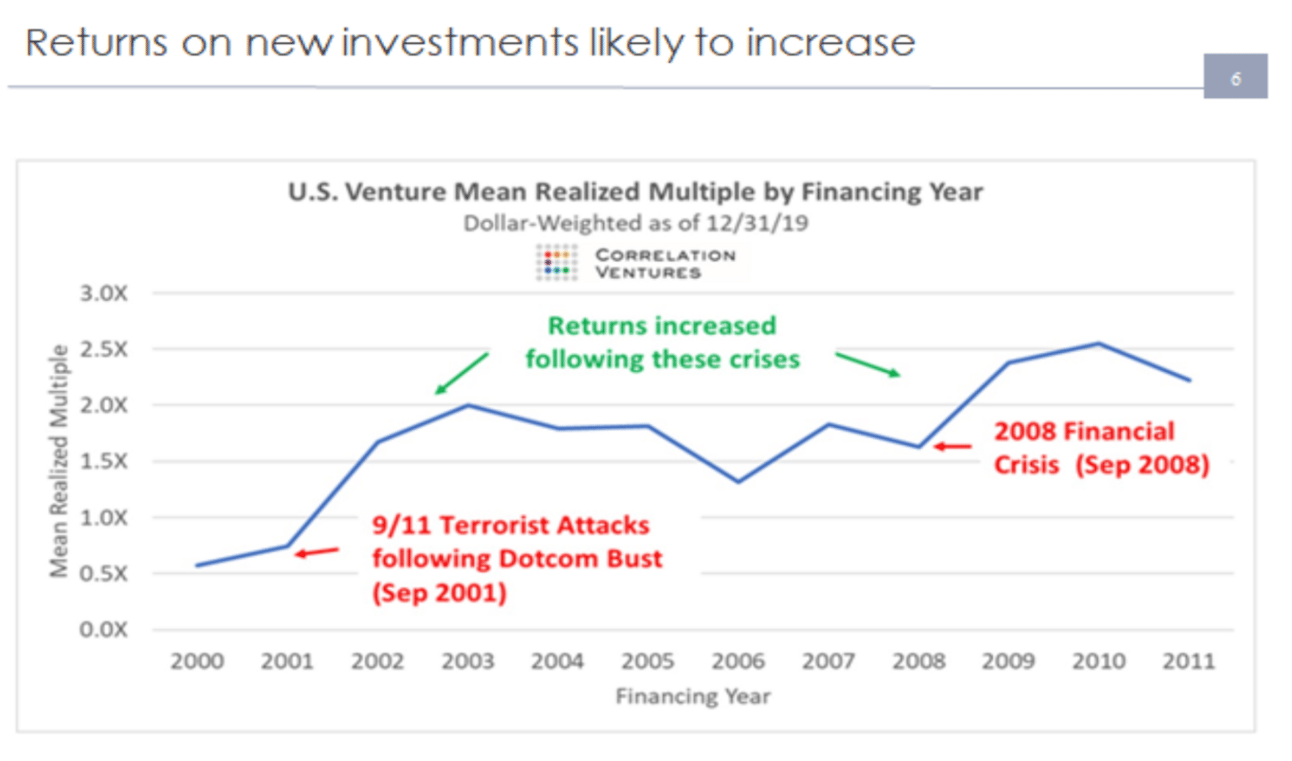

Why Downturns Create “Golden Vintages” in Venture

When markets turn volatile, capital gets scarce — and that’s exactly what makes the best vintages in venture. Lower entry prices, fewer competitors, and leaner startups all create conditions for outsized returns.

➡️ According to Cambridge Associates, the median VC fund raised during the 2009–2011 Global Financial Crisis delivered ~60% higher returns than those raised in the prior 2006–2008 boom.

“Recession-year funds had better upside and lower downside than peak-cycle funds.”

— CAIS, Golden Vintages Report

Even bottom-quartile VC funds from recession vintages fared better than average pre-recession vintages. And let’s not forget: Airbnb, Uber, WhatsApp, and Slack were all founded in the 2008–2010 window.

My LLM just invented the next generation of unicorns (right side) None of these startups exist (yet).

This cycle isn’t about selling socks online, streaming mobile videos, or renting your guest room to strangers. That was last season. This time, it’s about rewriting the rules of the real world — climate resilience, housing, healthcare, biodiversity, cybersecurity, sustainable agriculture, circular economy and yes - space. It’s not just another app. It’s the infrastructure of the new civilization. And the ones investing into the ventures from the ground up? Often not legacy firms — but domain-native, first-time managers with the urgency, depth, and clarity to lead this transformation.

Why Emerging Managers Deliver Superior Alpha

Backing first-time fund managers isn’t just about access — it’s a smart bet on performance.

72% of top-returning VC firms from 2004–2016 were emerging managers (Funds I–IV), per Cambridge Associates.

First-time funds outperformed non-first-time funds in 12 of 13 vintage years, according to Preqin.

Emerging managers consistently post higher median IRRs than their established peers.

So why does it happen?

Smaller fund sizes mean early-stage focus — the phase with the highest multiple potential.

Sharpened incentives — emerging managers need to perform; they can’t coast on fees.

Niche expertise & better sourcing — they're closer to the edge, and often, to the founders.

In fact, some LPs report that the chances of finding a top-decile fund are actually higher among first-time GPs than among household names.

Tailwinds Across Climate, Energy, and Frontier Tech

Downturns reset the playing field. Today, that coincides with some of the largest secular growth drivers in history

Clean energy & electrification (IEA forecasts >$2T/year needed in investment)

Circular economy and materials innovation

AI-enabled industry transformation

Nature-based finance & land regeneration

Backing domain-native emerging managers with a differentiated thesis remains one of the most effective ways to gain early exposure to the next generation of venture leaders. For LPs who do not have direct access to individual funds, there are several specialized fund-of-funds (FoFs) in the DACH region, Europe, and the U.S. that focus specifically on emerging managers.

We're currently curating a list of these FoFs with a strong track record in identifying and backing first-time and next-gen managers. If you're interested in receiving it, feel free to reply “FoF” and I am happy to send it your way.

Bests

Sandro

Sources and Deep Dives

Cambridge Associates – Private Investments: First-Time Funds

https://www.cambridgeassociates.com/insight/private-investments-first-time-funds/Preqin – First-Time Fund Performance (PDF Report)

https://docs.preqin.com/press/First-Time-PD-Feb-19.pdfPitchBook – VC Fundraising on Track for 67% Decline

https://pitchbook.com/news/articles/vc-fundraising-slow-venture-monitorCAIS – Golden Vintages in Private Markets

https://www.caisgroup.com/articles/golden-vintages-in-private-marketsIEA – World Energy Investment 2024: Overview and Key Findings

https://www.iea.org/reports/world-energy-investment-2024/overview-and-key-findings