Hi {{ firstname | Community }},

Yes, we’ve overhauled our look & feel a bit and optimized to increase value-add on your side, covering the most recent industry news. Let’s dive right in!

Today's Briefing

Vanagon News

Vanagon hosted a Rooftop Lunch & Pitch Event on top of the Deutsche Museum with Nandini Wilcke, COO of Carbon Insurance CarbonPool, and circularity expert Christian Adler

Dorothy Kelso, head of the global event series SuperReturn conducted an interview with Susanne on Vanagon and on key traits for creating happy relationships.

Sandro shared his view on portfolio construction in VC vs. PE and what is has to do with a bath tub 🛁

Vanagon was invited to the Earthshot Prize’s Launchpad event in London hosted by HRH Prince William:

🌍 Vanagon Update from London: Susanne just came back from the launch of The Earthshot Prize's new initiative, Launchpad - a funding platform initiated by HRH Prince William to boost Earthshot Prize winners and finalists by connecting them with investors. The event was a great opportunity to connect with well known climate tech investors, philanthropists as well as The Earthshot Prize winners and the team behind the prize. The Launchpad already offers investment opportunities of GBP 500m - thoroughly vetted through the Earthshot Prize’s due diligence process. A promising step forward in environmentalism and sustainable investment! Thanks for having us!

Fresh From The Portfolio

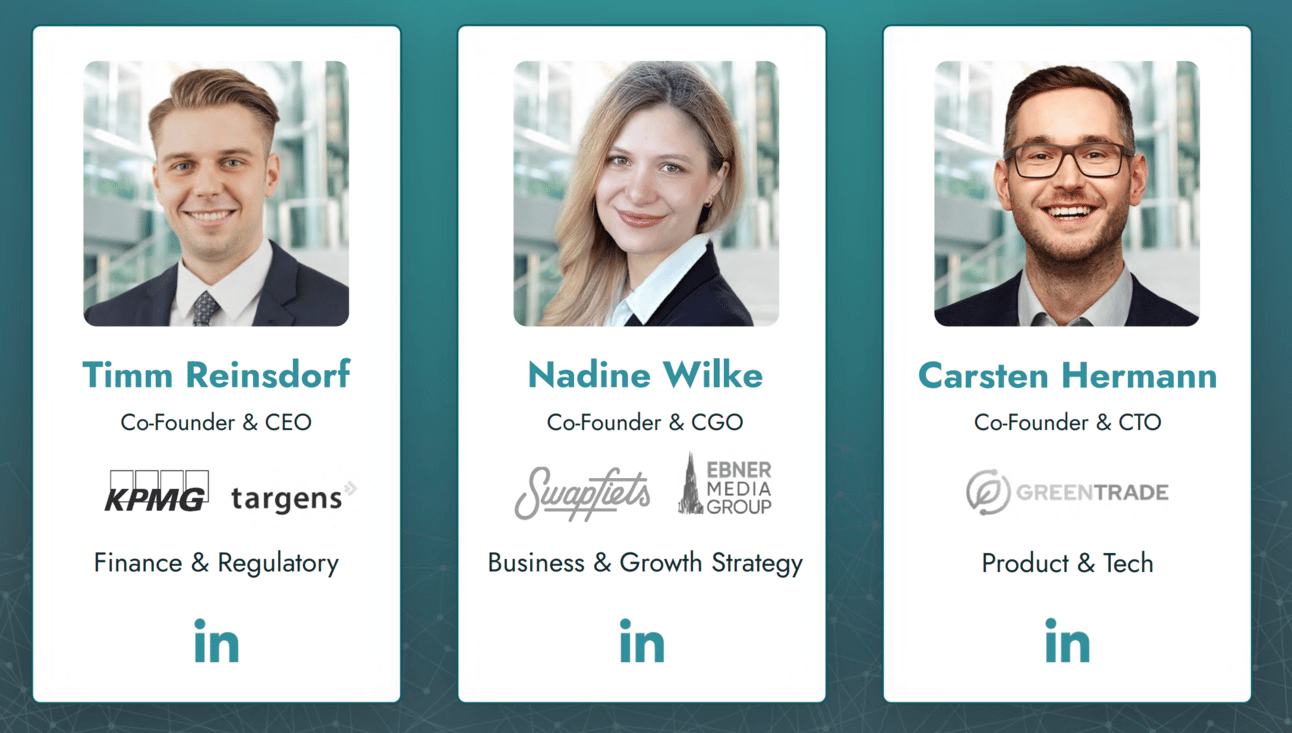

Futury Capital invests in Particula

Particula GmbH receives funding from Futury Capital, a Frankfurt-based venture capital fund, and other international investors. Particula, an up-and-coming start-up based in Munich, has developed an innovative rating platform that issues ratings for tokenised assets similarly to conventional rating agencies. Particula analyses tokenised assets based on economic, environmental, compliance and technological criteria. In addition to the Frankfurt venture capitalist, Plug & Play from Sunnyvale, California, and Hatcher+, a Singapore-based venture capital firm known for its data-driven approach to creating globally diversified portfolios, have also invested in Particula.

The Landbanking Group joins The Lab in a historic 2024 cohort to overcome climate finance barriers

Dr. Sonja Stuchtey, The Landbanking Group

The Global Innovation Lab for Climate Finance identifies, develops, and launches innovative finance instruments that can drive billions in private investment to action on climate change and sustainable development. Bloomberg Philanthropies, the United Nations Development Programme (UNDP), and the governments of Canada, Germany, the United Kingdom, and the United States fund the Lab’s 2024 programs. Climate Policy Initiative serves as the Secretariat and analytical provider. This group of ten solutions—the largest Lab cohort to date—seeks to build on the USD 4 billion that Lab alumni have mobilized to date. Congrats Landbanking Group Team - the best is yet to come!

Senken was featured in Tagesspiegel

Access the article here

This week in Climate & Tech

Open Forest Protocol issued their first ever credits! OFP is a tech-enabled registry platform for Carbon Credits.

Learn about carbon insurance on your morning walk in this recent podcast from Kita → Reversing Climate Change: 313: Can Carbon Removal Be Insured with Racheal Notto & James Kench, Kita

🦄 List of Europe’s climate tech soonicorns 🦄 by sifted

The World Meteorological Organization’ report is out and the evidence presented is alarming. 2014 to 2023 was the hottest decade on record. 2023 was the hottest year on record. 90% of the oceans experienced a heatwave and glaciers lost more ice than in any other year since records began. This a massive call for action: A structural transformation of our economy is without alternative.

Our take on: Nature Fintechs

NatureTech refers to the use of technology and innovation to address environmental challenges and enhance the conservation and restoration of nature. It includes the development of sustainable solutions and tools that help monitor, manage, and protect natural ecosystems, biodiversity, and resources, often integrating data analytics, artificial intelligence, and other digital technologies to optimize conservation efforts and promote sustainable practices.

NatureFinTechs and Blockchain Infrastructure play transformative roles in Nature Tech by enabling green finance, providing transparency and traceability in supply chains, facilitating the tokenization of natural assets, automating agreements with smart contracts, and supporting crowdfunding for environmental projects. These technologies help to mobilize resources, ensure the integrity of environmental efforts, and create new opportunities for investing in the sustainability and restoration of natural ecosystems.

Two years ago, the Nature Tech Collective launched with the idea of bridging the data gap between nature and the financial world to unlock billions of dollars for the regeneration of the planet. The nature technology sector plays a key role in this. The ability to mobilize financial resources is crucial to reverse the loss of nature and biodiversity. In the current quarter, the Collective is focusing on “NatureTech” and offers insights into the team's research. The NatureFinTech Taxonomy is of immense value to us, as it sorts this new category, which often interacts between new technologies, the financial world, and data. Senken and The Landbanking Group are also represented in our portfolio, and for the MRV area, we have nominated Renoster. You can find the report for download here.

NatureFintech Startups we backed since 2023

Renoster is a technology company that creates software and data platforms for the carbon markets. Deep transparency, powered by remote sensing, for the world's carbon projects.

The Landbanking Group is a nature fintech that brings nature to the balance sheet. The proponent built the first natural capital management platform and issues Nature Equity Asset Purchase Agreements between natural capital providers (land stewards) and buyers. Explainer video.

Senken are the experts in creating long-term high-value carbon strategies. With their AI-powered Carbon Scorecard companies can estimate their carbon footprint in 10 seconds. Check it out.

Who’s raising, Who’s hiring

Varaha raises $8.7M for digital MRV benefitting smallholder farmers

Green Fintech Bees & Bears is hiring a Founders Associate and BizDev - Special Perk🏖 📢 Unlimited vacation days for demonstrations and activism

Want to join a deep tech climate startup, thats moving markets? Join Renoster.co as an Account Executive

If you know someone who is 🇺🇸 up for the USA, who wants to work on an exciting AI learning app 🐙 in the middle of the AI metropolis San Francisco 🌉 in the House of AI, is mega motivated (and has at least an IHK degree + 1 year of professional experience or a university degree), reach out to Christian Byza.

Want to see your listing here?

Just reply to this mail and we’ll cover you.Thank you for your valuable time, we hope the read was worth it! Any topics missing? Let us know! Anyone you think should also read the Climate Tech Briefing? Please forward!

Have a great week and all the best

Axel, Sandro & Susanne