As of the end of last year we conducted the Final Close of our Fund I. We were delighted by the reception from press and on social media platforms: we received over 100.000 views and countless messages from the broader VC and Startup Ecosystem. The articles can be accessed by clicking on the links below the publications visual.

VC Magazin · Tech.eu · Menlo Times · EU-Startups · The Tech News Portal · StartupRise · Tech Funding News · Startup Kitchen · Startup Researcher · EU Agenda · Founders Today · VC Wire and others

Based in Munich, Europe’s DeepTech capital, we built Vanagon to back B2B founders from pre-seed who are tackling fundamental, system-level challenges and creating entirely new categories enabled by AI and DeepTech. Our strategy is in our DNA: We invest early in the brightest minds in tech and support them moving their companies up the curve by leveraging our network across corporate, tech and investors- built over our combined 60 years.

Many Thanks to our LPs, Friends and Supporters!

Deepdrive - Ecosystem Insights

DLD26 in a Wild World — and the Biggest Longevity Hack

Impressions from DLD 2026

DLD26 made one thing clear: sovereignty without resilience is meaningless. In a world shaped by geopolitical instability, AI disruption, and ecological loss, Europe’s path forward hinges on four levers: building VC-backed economic strength with smart regulation; technological sovereignty without isolation (control, not autarky); defending democracy and trust against misinformation; and treating nature as critical infrastructure, not a “nice to have.”

The paradox: while the world feels wilder than ever, we’re rapidly losing the wilderness we depend on. Prof. Dr. Martin R. Stuchtey, founder of our portfolio company The Landbanking Group, made a compelling „Case for Shock Absorbers: Europe’s New Critical Infrastructure Doctrine“. See link to the recording below.

Read Susanne’s full recap of DLD 2026 here - including the likely biggest longevity and happiness hack we have.

European VC’s Gender Gap and the Funds Starting to Close It

European venture capital remains overwhelmingly male. But the data shows a clear exception: funds focused on sectors such as deep tech and climate tech are starting to buck the trend. After analysing more than 200 European VC funds, this report highlights both the leaders and those with significant ground still to cover. We’re proud to be featured among the firms helping shift the industry. Happy seeing Vanagon featured among industry veterans like Climentum Capital, Contrarian Ventures, LUMO Labs, Planet A Ventures, High-Tech Gründerfonds, Ada Ventures 2150, AENU, Lightrock & Redstone. Read more.

Portfolio Spotlights

LoopID Team in Silicon: One AI Cycle Ahead

LoopID builds a commerce intelligence layer that uses context graphs to connect user, product, and behavioral data, enabling AI agents to deliver persistent, personalized, and transaction-ready experiences. The founders Christian and Alexis just spent five days recalibrating with founders, investors, and experts operating at the edge of AI adoption. To understand our conviction around LoopID, it is important to clarify what is structurally changing in commerce.

Silicon Valley is ahead in AI by one cycle. Roughly 12 to 24 months. A cycle is the minimum loop for a new idea to move from signal to standard.

Commerce has evolved from e-commerce (webshops), to mobile commerce (apps), to social commerce (discovery inside platforms) — and is now entering the agentic era, where AI agents guide and execute purchases on behalf of users.

For merchants and brands, this means shifting from campaign-driven marketing to persistent, data-driven intelligence. LoopID enables this transition by building the context graph layer that unifies fragmented customer and product data — empowering brands like BASF, Microsoft, Gore-Tex, Vitra, Fjällräven, HEDD and many others to deliver smarter personalization, higher conversion, and durable competitive advantage.

For this to work beyond demos, agents need three capabilities:

Reasoning (provided by LLMs)

Memory (persistent user and behavioral understanding)

Relational structure (mapping entities and their dependencies)

LoopID provide the latter two. They connect users, products, sessions, intent signals, constraints, and historical outcomes into a continuously updated semantic layer.

Portfolio Spotlight: From Learning to Lightning with Purple AI 💜

For three years, the two silicon-valley based Germans Christian Byza and Arnd Vogts built an enterprise learning platform. Then, they hit a wall and broke through it by reinventing how software is made. Last summer, they stopped just using AI to assist and started building entire products end-to-end in 48 hours. When they showed their work, the market gave them a clear signal: "We don't want the app; we want the engine." Today, they are productizing that engine with Purple AI—an orchestration layer that turns specs into real products on top of your existing codebase. While most teams are just "AI-assisted," Purple makes them "AI-first." It’s the end of development bottlenecks and the beginning of shipping at the speed of thought. They are looking for AI-curious companies with ambitious roadmaps that can't ship fast enough to become ai-native via bepuple.ai

36ZERO Vision: 2026 starts with a boom

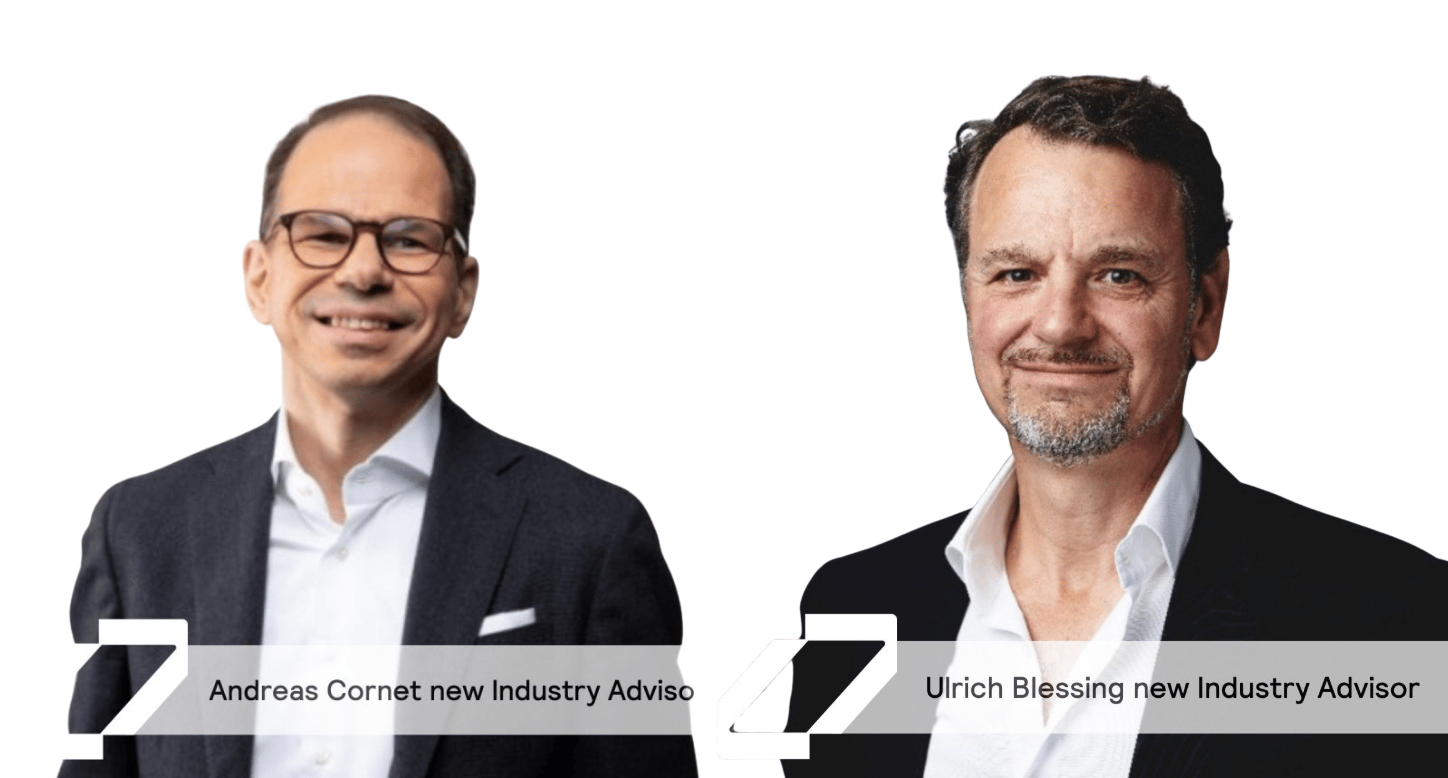

36ZERO Vision is starting strong. We’re excited to see Dr. Andreas Cornet and Ulrich Blessing join the Industry Advisor Board. With an impressive 30-year career as Partner Emeritus at McKinsey & Company, Andreas brings unparalleled experience in guiding global industrial champions through transformation, innovation, and growth. Ulrich Blessing brings deep experience from BCG, Blue Cap AG, and industrial leadership roles opening doors into world-leading manufacturers. We’re happy to have introduced Ulrich to the outstanding 36ZERO Vision team.

And that’s not all: the year kicks off strong with the 36ZERO Vision App now live on Siemens Industrial Edge 🚀 AI-powered, no-code, hardware-independent visual quality inspection — built for the factories of the future.

The Landbanking Group’s Nature New Stack launch at Davos

During the World Economic Forum in Davos, The Landbanking Group hosted the event "Nature’s New Stack”. It convened leaders from the "nature tech" community, financial institutions (such as LGT and Munich Re), and conservation organizations. The purpose was to present a new infrastructure designed to transform nature from an invisible background resource into a measurable, institutional asset class that can be invested in alongside traditional financial assets.

“The Landbanking Group Stack” is a revolutionary toolkit designed to simplify complex ecological science and standards into a "trusted interface" for financial markets. It consists of three specific layers that bridge the gap between nature and capital:

1. The Ecosystem Integrity Index (EII): This is the base measurement layer. It provides a single, scalable score (from 0 to 1) that assesses the local condition of any unit of land based on its composition, structure, and function. It serves as a "lingua franca" to make nature comparable across different contexts for banks and investors.

• 2. Nature Risk Premium: This layer focuses on risk and resilience. It connects the EII to financial risk models to show how healthy nature dampens climate shocks (like floods or droughts). This allows financial institutions to price capital and insurance premiums more accurately by accounting for the protective value of the ecosystem.

3. Nature Stock Pricing: This layer focuses on opportunity and future value. It introduces "Nature Stocks" as a new asset class. These instruments allow investors to finance nature's recovery today by holding a claim on the future ecological value and "uplift" (improvement) that the land will generate, rather than just paying for permits to pollute.

Watch The Landbanking Group stunning launch event of its Stack in Davos here or listen to our podcast summaries below.

When nature becomes a stock: Vanagon AI audio podcasts

#1 Overview of The Landbanking Group (English)

#2 DeepDive into the The Landbanking Group’s Stack (German)

Quick note before listening: These podcasts are 100% AI generated but hand-prompted with love from Munich - by Vanagon. We started an experimental AI-cast series highlighting DeepTech topics and companies. Looking forward to receiving your feedback!

Signals & Insights

SaaS is dead. Agents killed it.

Anthropic’s new work-execution layer has triggered a $285B market wipeout, signaling the death of "middleman" software that relies on pretty UIs and per-seat pricing.

Straight from Europe: OpenClaw founder Steinberger predicts 80% of apps will vanish. His local agent controls PCs autonomously, favoring privacy and swarm intelligence over cloud AI.

The German VC market is showing remarkable stability despite broader European challenges, with Germany overtaking the UK in fundraising.

All the best!

Sandro, Axel & Susanne