Dear Vanagon Community,

Yes, we’ve overhauled our look & feel a bit - just in time to provide you with a crisp review of the past months. Just like our first half of 2024, the second half was eventful and exciting and we would like to thank everyone who has supported us along the way!

Let’s dive right in.

Portfolio

Our portfolio is continuously growing. We now have concluded our 14th investment and are looking forward to announcing the most recent deals shortly.

A highlight in Q4, 2024, was definitely also our lead investment in AI-Materials startup ExoMatter, which was covered by international media such as EU-Startups and national publications like VC Magazin (below).

Also the developments in our existing portfolio companies continue to delight. They include, apart from new financing rounds, various new customers won and jobs created, also milestones such as these:

Senken launched its Deutschland Portfolio, a portfolio selection of the highest-quality carbon credits “Made in Germany”.

Particula is about to launch a rating project for its Tokenized Treasuries Product for a $1.3 trillion AUM asset manager.

The Landbanking Group was awarded as “Best Start-up of the Year” in the category of “Artificial Intelligence” at the Süddeutsche Zeitung’s SZ Wirtschaftsgipfel.

LoopID won the WECONOMY Award (in collaboration with UnternehmerTUM, Handelsblatt and various corporate partners) as well as the Startup Night 2024 hosted by Infineon Technologies.

Platform Activities

Rooftop Series

Our Vanagon Investors Rooftop series continues to attract amazing individuals keen to connect, learn and play an active part in shaping our future economy. We very much enjoy the regular conversations on top of the Deutsches Museum in Munich. Our latest edition took place in December and was co-hosted by The Landbanking Group:

ReFi Talents Program

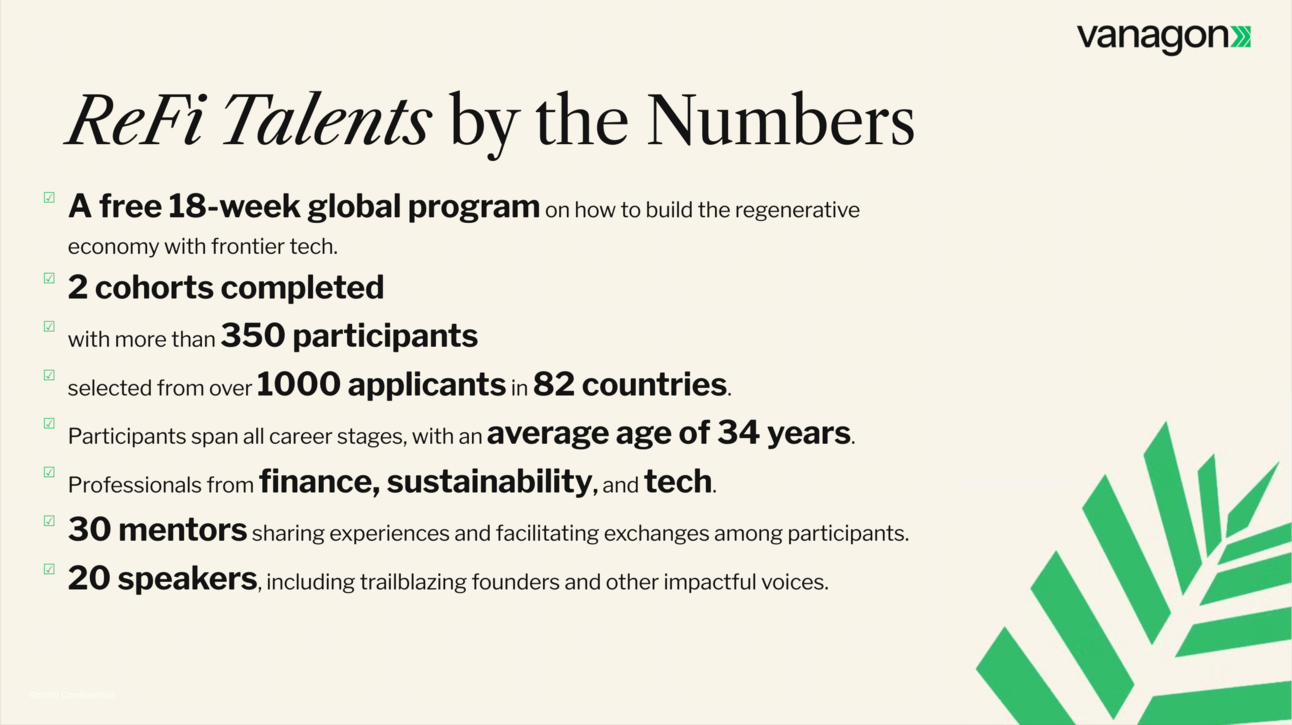

Our Education Program: In December, we concluded the 2nd cohort of the ReFi Talents program that we created in collaboration with the Frankfurt School of Finance and ECOTA. The 18-week long global online program helps professionals from various backgrounds to onboard into the regenerative economy and to learn how digital DeepTech can accelerate the green transition. Upon the completion of the recent 2nd ReFi Talents cohort, we have educated more than 350 participants, selected from over 1000 applicants from 82 countries, spanning all career stages (average age 34). The participants came from startups as well as corporates and are professionals in the areas of finance, sustainability and tech. Speakers included founders from our portfolio companies LoopID, Renoster, The Landbanking Group, Senken, and Particula, the Vanagon GPs as well as impactful voices in the space such as indigenous leaders, the UN Innovation Accelerator, the Climate Collective, and African Parks.

External Events & Recognitions

In the second half of 2024, we participated in and spoke at various events such as

Bits & Pretzels in Munich

DLD Nature in Munich

Slush’D Green Tech Panel in Heilbronn

VdU Impact Investing Panel

European Women in VC Conference in Paris

Climate Nexus in Berlin

Rentenbank Demo Night in Frankfurt

UnternehmerTUM Demo Day, Bayern Kapital Connect, and VentureCon in Munich

Award Finalist: Susanne was recently selected as a finalist for the prestigious INSEAD Business Sustainability Award 2025, which will be awarded in February, 2025, at the INSEAD Hub in San Francisco. We are thrilled about this selection, as INSEAD ranks among the world's leading business schools, with a strong network of 70,000 alumni across 178 countries.

The Earthshot Prize: Vanagon has been invited to be one of the Official Nominators, a group of organizations from around the world tasked with submitting nominations to this ambitious and exciting Prize. Initiated by HRH Prince William in 2020, The Earthshot Prize is awarded across five categories: Protect and Restore Nature, Clean our Air, Revive our Oceans, Build a Waste-Free World, and Fix our Climate.

Invitation to the Why You Venture Capital Podcast: Host Eugene Hoo visited the Vanagon Office in early December and we recorded a very personal conversation about why we at Vanagon are rethinking the key metrics for startup success, and what hidden potential Munich holds for founders. Listen on Spotify

External Education Sessions: Apart from our ReFi Talents, we were also active in external education programs. Vanagon held several learning sessions on NatureTech and related topics and was one of the investors teaching at the Evangelistas Super Angels Program, a 10-week education program for female business angels, alongside investors from VC such as La Famiglia, World Fund, or Speed Invest and notable business angels.

If you would like to read more 2024 reviews, check out our Vanagon summer reflections looking back at the first half of the year.

Our take on the Market:

Despite current geopolitical challenges, the European venture capital market has proven resilient. An investment volume of approximately $45 billion is projected for 2024, slightly below last year’s $47 billion, but still robust.

While many European countries saw declines, investments in German startups rose by over a third in Q3, reaching $2.4 billion, underscoring Germany's increasing significance in innovation areas such as DeepTech and Climate. Notably, Munich remains a top innovation hub with 187 startups founded in H1 2024.

EU DeepTech investments currently total €58 billion compared to €215 billion in the U.S., but Europe's growth rate is three times higher. The potential of Digital DeepTech—including AI, advanced IoT, and Distributed-Ledger technologies—is estimated at €3 trillion by 2030.

Digital DeepTech is a key driver of the green transformation and the restoration of critical natural infrastructure. The EU Green Deal legislation provides a stable framework and demand for green innovations. Moreover, anticipated setbacks in green initiatives under the new U.S. administration present a major opportunity for Europe and for Germany in particular to strengthen their roles as leaders in this domain.

Private capital plays a crucial role in realizing this historic opportunity. There has never been a more critical and promising time to invest in both sustainable and technological innovation.

With this, we are wishing you wonderful holidays and a good start into a happy and healthy year 2025!

Susanne, Sandro and Axel